Take Aways From the Latest BizBuySell Quarterly Report

BizBuySell is an online resource that focuses on offering unique content that specifically addresses the needs of buyers and sellers. To make this happen, BizBuySell has teamed with a range of experienced business brokers who are covering topics relevant to business owners, buyers, and sellers.

KEY FINDINGS

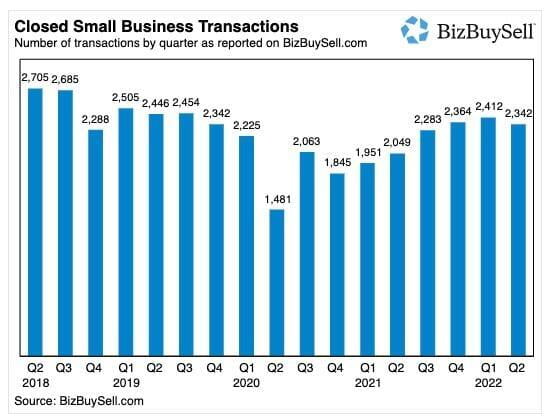

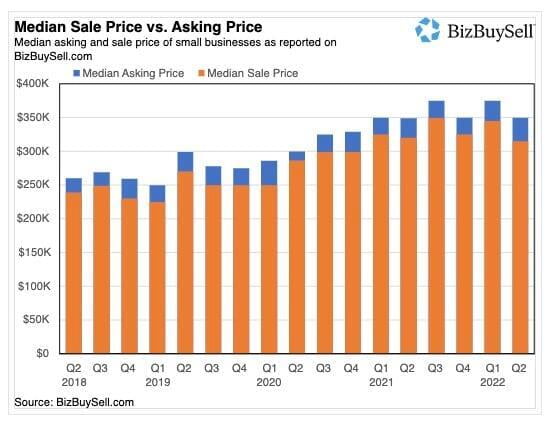

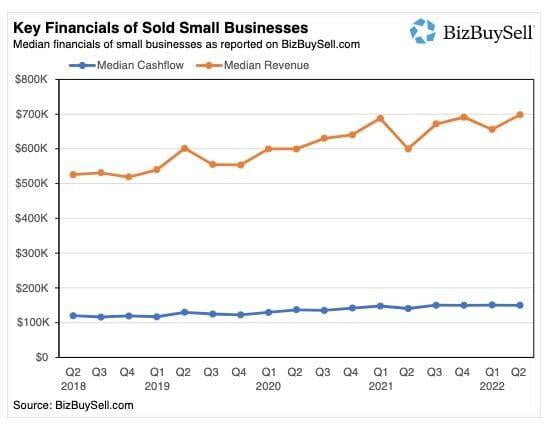

Small business acquisitions slipped 3% in Q2 of 2022, but still gained 14% year-over-year, suggesting a strong market navigating economic headwinds. More pronounced, the median sale price dropped 9% below the previous quarter from $345,000 to $315,000, but which is still just 2% below last year's $320,000. The drop in sale price appears linked to more realistic prices, perhaps pricing in inflation and recession concerns, as indicated by a 3% quarter over quarter drop in average cashflow multiple of sold businesses. This data is from BizBuySell's Insight Report, which tracks and analyzes business-for-sale transactions and sentiment of business owners, buyers, and brokers.

Still, market performance continues to match and, in many cases, outperform pre-pandemic levels. Businesses sold at a median price 17% higher compared to Q2 2019 and possessed stronger financials, with median revenue 16% higher, and median cashflow 15% higher, respectively. Moreover, businesses sold at a faster pace. The median days on the market dropped 6% in Q2 over the previous quarter from 181 to 171 days. With the Federal Reserve rapidly increasing interest rates, it is likely buyers in today's market are seeking a faster close to lock-in lower interest rates.

Transactions still lag pre-pandemic levels by a small margin. The 2,342 businesses reported as sold in Q2 2022 is 4% shy of the 2,446 sold at the same time in 2019. Growth over the next few quarters likely hinges on several micro and macro factors. These range from the Fed's success of a ‘soft landing' to whether the anticipated ‘Silver Tsunami' of Baby Boomers decide now is the time to exit.

PRICES REDUCED TO ACCOMMODATE BUYER COST OF CAPITAL

The $350,000 median asking price of businesses sold in Q2 dropped 7% over Q1, reaching the same level recorded in 2021 despite stronger financials compared to a year ago. Multiples dipped as well, with average revenue and cashflow multiples down 6% and 3% respectively vs last quarter; and down 6% and 1% compared to last year. This indicates sellers are receiving less to accommodate buyers.

Buyers surveyed echoed a sentiment on interest rate hikes possibly negatively affecting acquisition cost, with the majority (39%) saying interest rate hikes are impacting their ability to finance a business acquisition. This includes lenders increasing down payment requirements as well as tighter monetary policy having a ripple effect on investment portfolios, reducing buyer liquidity.

As current June CPI data suggests continued and potentially aggressive Fed rate hikes, owners able to offer seller financing may find themselves in the driver's seat of negotiations and able to command a higher value as a result. Still, there are other options a seller can take to ensure a sale price that meets or exceeds their expectations.

SELLERS ARE MORE REALISTIC ABOUT VALUATIONS AMID ECONOMIC UNCERTAINTY

With inflation and interest rate hikes driving increased economic uncertainty, buyers are not the only ones becoming more cautious with deals. Sellers are up against these same dynamics, making them more realistic about valuation and asking price. Moreover, sellers are having to choose whether to get into the market now rather than hold off for conditions to change, especially those with declining businesses.

Of owners surveyed, 40% believe they would receive a higher price had they sold last year, mostly pointing to buyer recession concerns (52%), buyer inflation concerns (40%), and declining revenue (38%). Based on this, it is no surprise that recession concerns are the top macro-economic factor influencing surveyed owners to consider selling their business, followed by labor shortage and inflation.

RISING COSTS CUT PROFITS, LABOR PAINS CONTINUE

Businesses sold in Q2 reported strong sales, yet slimmer profits. Over the past quarter, median revenue rose 6.5% compared to Q1, while median cashflow dropped 0.5%. This speaks to the necessity for owners to raise prices to offset higher costs to avoid hurting their bottom line.

Of owners surveyed, high cost of goods was most selected (21%) as having the biggest negative impact on the profitability of their business, followed by the cost of gasoline (17%), the cost of labor (16%), and reduced customer spending (16%).

"My biggest issues are the lack of parts and the cost of the parts. Parts have gone up big time in cost. We also are having to pay a lot more for employees. Automotive techs are becoming extremely difficult to find and we are paying much higher labor costs for those techs," said Brian Bender of Tuffy Service Center in Michigan.

In fact, labor is possibly the most important aspect of a successful sale. The biggest concern for most owners talked with is maintaining a strong, qualified work force. Most of my clients have long-tenured employees. A dependable workforce is also a concern of the buyers as well as potential supply chain issues and inflation.

Small businesses are struggling to attract workers, sometimes forcing them to turn away customers. Others have no choice but to pay higher wages, forcing them to raise prices to maintain profitability. Some are debating shutting down altogether.

Of owners surveyed, 40% believe they would receive a higher price had they sold last year, mostly pointing to buyer recession concerns (52%), buyer inflation concerns (40%), and declining revenue (38%). Based on this, it is no surprise that recession concerns are the top macro-economic factor influencing surveyed owners to consider selling their business, followed by labor shortage and inflation.

RISING COSTS CUT PROFITS, LABOR PAINS CONTINUE

Businesses sold in Q2 reported strong sales, yet slimmer profits. Over the past quarter, median revenue rose 6.5% compared to Q1, while median cashflow dropped 0.5%. This speaks to the necessity for owners to raise prices to offset higher costs to avoid hurting their bottom line.

Of owners surveyed, high cost of goods was most selected (21%) as having the biggest negative impact on the profitability of their business, followed by the cost of gasoline (17%), the cost of labor (16%), and reduced customer spending (16%).

"My biggest issues are the lack of parts and the cost of the parts. Parts have gone up big time in cost. We also are having to pay a lot more for employees. Automotive techs are becoming extremely difficult to find and we are paying much higher labor costs for those techs," said Brian Bender of Tuffy Service Center in Michigan.

In fact, labor is possibly the most important aspect of a successful sale. The biggest concern for most owners talked with is maintaining a strong, qualified work force. Most of my clients have long-tenured employees. A dependable workforce is also a concern of the buyers as well as potential supply chain issues and inflation.

Small businesses are struggling to attract workers, sometimes forcing them to turn away customers. Others have no choice but to pay higher wages, forcing them to raise prices to maintain profitability. Some are debating shutting down altogether.

It would appear labor is a challenge for even the most successful businesses. Of surveyed owners who believe their business is more valuable today than a year ago, labor shortage was selected as hurting their business the most. Sixty-seven percent (61%) said the labor shortage was negatively impacting their business, more than half very negatively. Beyond maintaining day-to-day operations, a full and experienced staff is normally a critical requirement for buyers, making labor challenges troublesome for those looking to exit as well.

SERVICES AND RECESSION PROF BUSINESSES REMAIN POPULAR

The services sector continues to lead business for sale transactions. Among buyers surveyed, these businesses are the most sought after (40%), followed by retail (29%). More specifically, buyers are seeking ‘recession-proof', essential services, such as auto repair shops, healthcare businesses, cleaning services, and financial services.

The essential business theme has been consistent since the first half of 2020, where buyers seek certainty in uncertain times. It has also been amplified by the recent Great Resignation, which saw heightened interest in the independence associated with small business ownership, from private sector workers. A business with reliable operations and performance is of especially great value to a first-time business owner that lacks the experience required to navigate a rocky economy.

RATE HIKE HEADLINES

Despite the dip in Q2 transactions from the first quarter, the market rebound remains intact with acquisitions up 58% since activity stalled in 2020. That said, current economic conditions are likely to present a short-term speed bump in the road to complete recovery. This is particularly true for buyers having to navigate more expensive financing.

Forty-nine percent (49%) of surveyed buyers said they are delaying their purchase due to Federal Reserve Rate hikes. At the same time, continued record traffic to BizBuySell indicates demand remains, so, it's likely buyers are pausing to recalibrate what they can afford. "Rates pretty much only had room to go up, so the increase doesn't change my desire to buy a business though it does change the menu of options available," said a buyer who wished to remain anonymous.

While some are looking at lower priced businesses, others anticipate owners dropping prices instead. Twenty-four percent (24%) of buyers expect a lower price today compared to a year ago. This is an optimistic minority compared to the 41% still expecting to pay more and 35% seeing values remain the same.

"Higher rates make me qualify for less money because my existing debt service increases. But the business price should also fall so it is likely a wash," said a buyer named Andrew of South Dakota who is looking for a business with cashflow and synergies to complement his engine component modification startup.

While macro conditions are playing a big factor in buyer behavior, owner decisions remain mostly personal with retirement and burnout topping the list.

"I am tired. Managing my business through COVID made me tired," said D. Swanson, owner of Parr Creek Bakery and Café in Montana. "36 years success since I created my company. I turn 65 in September. Time to slow down and enjoy the grandkids. Plus, the hassle of hiring help in our rural area has quite frankly worn me down. It is time for fresh owners with the energy needed to keep up with our sales demands."

While not the main motivator for sellers, the economy is likely to impact timing. Of those considering selling their business, recession concerns were the top economic element playing a factor in that decision, affecting 26% of owners. This was followed by labor shortage (25.5%), cost of labor (25.3%), and supply chain issues (17.7%). Counter to buyers, interest rates had little influence at 11.3% and finally the Ukraine War just 2.8%.

It is important to note that buyer activity has led the charge back to pre-pandemic transaction levels, with a lower volume of sellers holding things back. Now we face an environment where owners are showing signs of exhaustion and ready to relinquish the reigns. At the same time, buyers are running into financing roadblocks and a little more risk. Consensus is that these conditions will remain until the Fed pivots and rates reverse or settle.

Ultimately, we expect deal flow to continue at consistent levels as the backlogged outflow of retiring Baby Boomers fuels the market with enough opportunity to keep buyers engaged. In addition, with sale prices still at historically high levels, owners should be able to discount rates while still walking away with enough to support whatever comes next. In addition, any owner able to offer seller financing will likely find themselves in a more favorable position in today's market.

For entrepreneurs thinking of making a change, the best advice is to consider your capital and timeline. Set sights on opportunities that accommodate both, then make an offer. The only thing to lose is time.