Blog

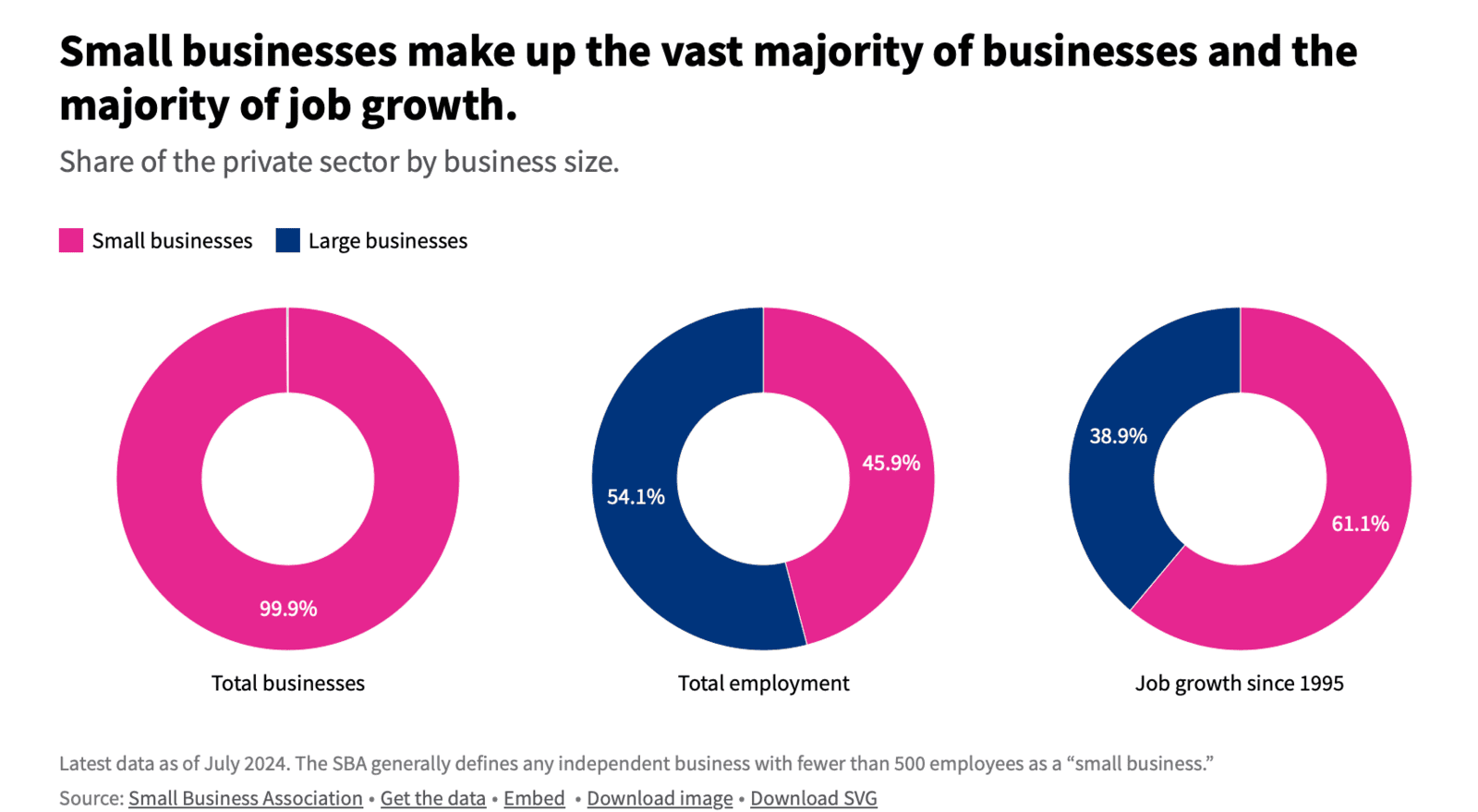

What Role Do Small Businesses Play in the Economy

03.06.25 04:09 PM - Comment(s)

Entrepreneurship has increased since the pandemic, accounting for the bulk of job growth. Small business development in the US declined in the four decades before the pandemic — but since 2020, this chunk of the private sector has been driving the bulk of job growth.

Post Closing Steps for a Successful Transition

03.06.25 03:45 PM - Comment(s)

Once the deal is sealed and the closing is complete, many business owners might think their job is done. However, ensuring that the transition to the new owner goes smoothly is crucial not only for the business’ continued success, but also for protecting your own ongoing interests.

Strategic Negotiation: Essential Tactics for Deal Success

02.06.25 08:06 PM - Comment(s)

Negotiation can evoke a range of feelings: some people thrive on it, others dread it, and many fall somewhere in between. Regardless of your stance, the ultimate goal remains the same: to emerge successfully from the negotiation.

The Risks of Under-Reporting Income for Business Owners

02.06.25 07:57 PM - Comment(s)

One of the most critical questions for prospective buyers, investors, and lenders is understanding a business’s true income. However, it should come as no surprise that the party most invested in uncovering this information is the Internal Revenue Service (IRS).

International Business Brokers Association Recognizes Mark Herrmann and Trustmark Mergers & Acquisitions for Strategic Excellence

27.05.25 03:14 PM - Comment(s)

International Business Brokers Association recognizes Mark Herrmann and Trustmark Mergers & Acquisitions

FOR IMMEDIATE RELEASE May 20, 2025

Orlando, Florida. The International Business Brokers Association (IBBA) has recognized Mark Herrmann, President of Trustmark Mergers & Acquisi...

Categories

- Uncategorized

(1)

- Business Assistance

(8)

- Sales Guidance

(7)

- Covid-19 Making Payroll

(0)

- Digital Advertising Grants

(0)

- Charitable efforts during Covid-19

(1)

- Government Assistance

(0)

- Economic Impact of Covid-19

(1)

- Business Operations Post Covid-19

(0)

- Section 1112 of Cares Act

(0)

- Virtual Tours and Free Stuff

(0)

- PPP Loan Forgiveness

(0)

- Business Valuations

(2)

- business advertising

(0)

- PPP Loan Forgiveness Estimator

(0)

- ESOPs

(0)

- Business Sale Tips

(11)

- Tax Planning

(6)

- Consolidated Appropriations Act of 2021

(0)

- Real Estate

(0)

- Accolades

(0)

- Buyers

(0)

- Seller Financing

(0)

- Confidentiality Agreements

(0)

- Market Report

(2)

- SBA Business Loans

(1)